Research firm GfK and international research center Marcs have published a jointly compiled list of the most interesting banking innovations of 2015.

To select innovations, we used monitoring of the websites of banks that operate in Russia and are in the top 100 in terms of assets. Also, data from 12 specialized industry sites were taken into account, whose topics are banks and finance. And an online survey was conducted of 600 people from cities in which more than one hundred thousand people live. They were asked to choose the three most interesting services from the proposed list (without specifying a specific bank).

Introducing you top 5 most popular banking innovations in Russia.

5. Instant issuance of an unnamed plastic card

Of all the respondents surveyed by GfK, 28% like the opportunity to receive a card at a bank branch in 10 minutes that is not tied to the client's name. This innovation was launched by Alfa-Bank. To receive a card, a client must use the services of Alfa Bank, that is, his personal data is already in the system.

Of all the respondents surveyed by GfK, 28% like the opportunity to receive a card at a bank branch in 10 minutes that is not tied to the client's name. This innovation was launched by Alfa-Bank. To receive a card, a client must use the services of Alfa Bank, that is, his personal data is already in the system.

4. Scanning documents using your smartphone

People aged 30 and over value their time very much. Therefore, they most liked the ability to scan payment and other data through the smartphone camera (using the QBank app), rather than typing them manually. The creators of the application took care of the possibility of scanning receipts for payment of utility bills, scanning a payment card (to link it to the application or transferring to another card) and scanning a driver's license and vehicle registration document. The last option is useful for those who need to pay a traffic fine. For the first time, such a service was launched by Svyaznoy Bank, and 29% of those surveyed by GfK and Marcs voted for it.

People aged 30 and over value their time very much. Therefore, they most liked the ability to scan payment and other data through the smartphone camera (using the QBank app), rather than typing them manually. The creators of the application took care of the possibility of scanning receipts for payment of utility bills, scanning a payment card (to link it to the application or transferring to another card) and scanning a driver's license and vehicle registration document. The last option is useful for those who need to pay a traffic fine. For the first time, such a service was launched by Svyaznoy Bank, and 29% of those surveyed by GfK and Marcs voted for it.

3. Notifications about fines and taxes by SMS

This innovation of B&N Bank was noted by 33% of respondents. This service allows you to timely pay any debts to the traffic police, the Federal Tax Service and bailiffs. To receive information about taxes in the personal Internet account of the bank, you need to indicate the TIN, and in order to receive an SMS about traffic fines, the number of the car registration certificate or driver's license.

This innovation of B&N Bank was noted by 33% of respondents. This service allows you to timely pay any debts to the traffic police, the Federal Tax Service and bailiffs. To receive information about taxes in the personal Internet account of the bank, you need to indicate the TIN, and in order to receive an SMS about traffic fines, the number of the car registration certificate or driver's license.

2. Pay for purchases using a smartphone

What could be simpler: I put my mobile device to the terminal at the store checkout and all purchases are immediately paid for. No need to rummage through your wallet looking for the right amount and catch the impatient glances of the cashier and other people in line. Such a convenient innovation, which was first launched by Surgutneftegazbank, was highlighted by 39% of respondents.

What could be simpler: I put my mobile device to the terminal at the store checkout and all purchases are immediately paid for. No need to rummage through your wallet looking for the right amount and catch the impatient glances of the cashier and other people in line. Such a convenient innovation, which was first launched by Surgutneftegazbank, was highlighted by 39% of respondents.

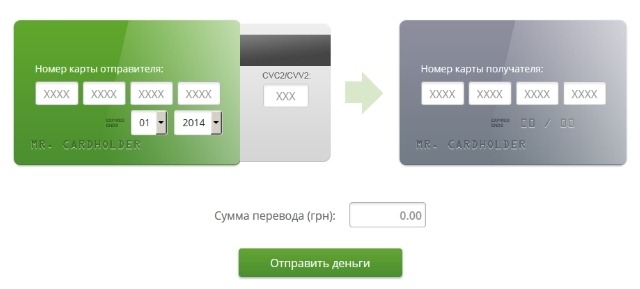

1. Transferring money to a card from a card of another bank

In the first place in the rating of the most popular Russian banking innovations is the service offered by B&N Bank since March 2015. Most of all, residents of cities with a population of more than 300 thousand people (45% of respondents) liked the opportunity to replenish their card online from cards of other banking organizations. And noticeably less interest in it was shown by residents of small and medium-sized cities (from 100 and 249 thousand people) - 35% of respondents.

In the first place in the rating of the most popular Russian banking innovations is the service offered by B&N Bank since March 2015. Most of all, residents of cities with a population of more than 300 thousand people (45% of respondents) liked the opportunity to replenish their card online from cards of other banking organizations. And noticeably less interest in it was shown by residents of small and medium-sized cities (from 100 and 249 thousand people) - 35% of respondents.