Some regions of Russia are so unprofitable for Russian auto insurers that they refuse to sell OSAGO policies in all possible ways (or they sell only together with various additional services).

The Russian Union of Auto Insurers (RSA) analyzed a number of parameters, including:

The Russian Union of Auto Insurers (RSA) analyzed a number of parameters, including:

- how frequent are insured events;

- how much money was paid in Russia on average;

- what is the ratio of court and “regular” payments;

- whether there are more contracts;

- the ratio of overhead costs in court to the amount demanded by the car owner;

- the level of payments in a certain region for January-September of this year

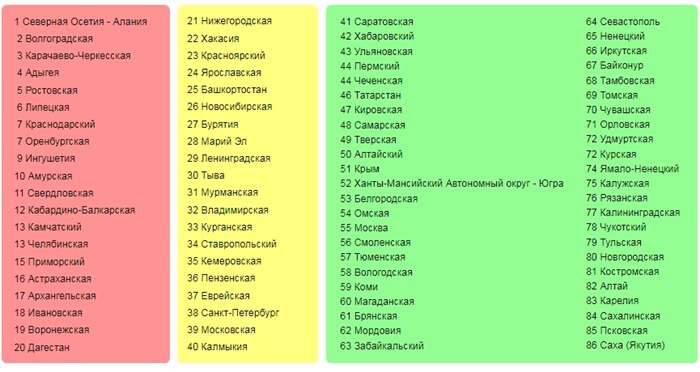

and made up the top 20 most problematic regions for OSAGO in 2017. The regions of the Russian Federation that are negative in terms of fraud and unprofitableness of insurers are marked in red in the list. Compared to 2016, Primorsky Krai moved from the yellow ("risky, but tolerable") area of the list to the red one. Previously, it was in the fortieth place, and in the current list of "toxic" regions by OSAGO 2017 it took the fifteenth line. The situation in Lipetsk and Orenburg regions is not good for the PCA representatives.

Reading complaints insurance companies OSAGO the question involuntarily arises: are there any regions where things began to be better for them, and not worse in 2017? It turns out there is. These are Krasnodar Territory, Tatarstan and Chelyabinsk Region.

This is how the complete list of the most unprofitable for OSAGO and quite prosperous subjects of the Russian Federation for auto insurers looks like.

The PCA does not like auto lawyers who buy out the rights of claim from car owners to the company in which the car is insured. The insurers have dubbed such people fraudsters.

According to the head of RSA Igor Yurgens, "fraudulent actions" of auto lawyers lead to the fact that they receive much larger sums than the insurer should have paid to their client.

But many car enthusiasts have a much better attitude towards car lawyers than PCA. They believe that insurance companies underestimate the amount of payments for compulsory motor third party liability insurance, and only with the help of competent specialists it is possible to achieve justice in court.

According to the PCA, the average payment for compulsory motor third party liability insurance in Russia is 79.5 thousand rubles, but car owners from 14 Russian regions were more fortunate, since there the average payment amount exceeded one hundred thousand rubles.

Legislative efforts have not helped reduce liability insurance fraud. This year, the frequency of insured events increased by 0.4%, the average payment increased by 15%, and the ratio of judicial and non-judicial payments increased to 14.1% (this is 0.3% higher than a year ago).