Millions of people devote their time and money to Forex operations in the hope of making good money. And someone really succeeds in playing on the difference in exchange rates.

Millions of people devote their time and money to Forex operations in the hope of making good money. And someone really succeeds in playing on the difference in exchange rates.

The success of a trader depends on theoretical training, experience, and intuition. Today we propose to consider four of the most successful trades in the history of Forex, which are an example of how courage, calculation and intuition play into the hands of a trader.

Of course, the players had at their disposal huge funds, but the main thing that these examples teach is the ability to rely on facts from the sphere of politics and economics.

4. Warren Buffett and the US dollar

By the early 2000s, the "Oracle of Omaha" had already acquired a reputation for being a man of great business intuition, as it earned its first millions in 1965. Until 2002, Buffett had never played the currency. Buffett's first deals were cautious, the great investor "tried his hand". A year later, in 2003, Buffett's investment company Berkshire Hathaway made $ 1.3 billion in a deal to buy five foreign currencies against the dollar.

By the early 2000s, the "Oracle of Omaha" had already acquired a reputation for being a man of great business intuition, as it earned its first millions in 1965. Until 2002, Buffett had never played the currency. Buffett's first deals were cautious, the great investor "tried his hand". A year later, in 2003, Buffett's investment company Berkshire Hathaway made $ 1.3 billion in a deal to buy five foreign currencies against the dollar.

With a stunning profit, Buffett proved that he can predict not only the dynamics of the price of securities, but also the exchange rates.

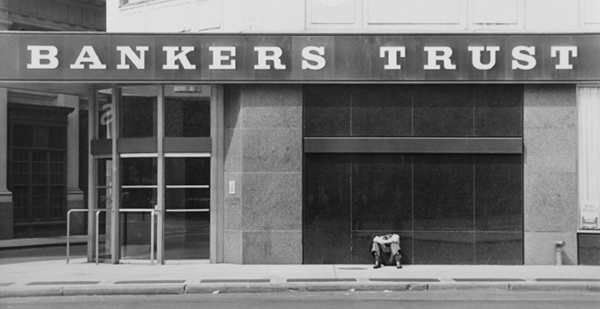

3. Andy Krieger and the New Zealand dollar

In 1987, Bankers Trust trader Andy Krieger monitored currencies that rallied against the US dollar following the Black Monday crash. Naturally, rushing from the dollar to other currencies, traders clearly overestimated some monetary units. Krieger's attention was drawn to the New Zealand dollar, or "kiwi," as the stockists called it.

In 1987, Bankers Trust trader Andy Krieger monitored currencies that rallied against the US dollar following the Black Monday crash. Naturally, rushing from the dollar to other currencies, traders clearly overestimated some monetary units. Krieger's attention was drawn to the New Zealand dollar, or "kiwi," as the stockists called it.

Andy Krieger had considerable funds at his disposal, as he represented a large investment company in Forex. By shorting several hundred million dollars against the kiwi, he got the NZ dollar down 5%. Krieger brought his employers millions of dollars in profits.

2. Standley Druckemmiller and the Deutsche Mark

A trader at George Soros' Quantum Fund, Standley Druckemmiller went long against the German currency during the fall of the Berlin Wall. The extreme decline in the Deutsche Mark and the correct market assessment yielded a yield of 60% of the deal. A couple of years later, Druckemmiller again bet on the mark, but now on the assumption that it will rise against the British pound.

A trader at George Soros' Quantum Fund, Standley Druckemmiller went long against the German currency during the fall of the Berlin Wall. The extreme decline in the Deutsche Mark and the correct market assessment yielded a yield of 60% of the deal. A couple of years later, Druckemmiller again bet on the mark, but now on the assumption that it will rise against the British pound.

Drukemmiller correctly assumed that the UK in those years sought to stimulate business and attract investment, for which it reduced rates and the exchange rate of the national currency. The second deal was equally successful, bringing in millions of dollars in revenue for the Quantum Fund.

1. George Soros and the British pound

This Forex game has a relationship with the Standley Druckemmiller deal. Soros understood that Britain's desire to keep the pound sterling high was not justified from the point of view of the economic situation. Soros began to open short positions against the pound, betting huge amounts of money. Having accurately calculated the moment when the British currency would collapse against the German mark, Soros earned at least a billion dollars.

This Forex game has a relationship with the Standley Druckemmiller deal. Soros understood that Britain's desire to keep the pound sterling high was not justified from the point of view of the economic situation. Soros began to open short positions against the pound, betting huge amounts of money. Having accurately calculated the moment when the British currency would collapse against the German mark, Soros earned at least a billion dollars.