During the crises of 2008 and 2014. MACON consultants constantly monitored the situation on the real estate markets of the largest Russian cities. The dynamics of market indicators has always been different. This depended on the level of competition and the degree of market saturation, prices and income levels of the population. At the same time, past crises were largely of a macroeconomic nature, while problems in 2020, in addition to a macro component (falling oil prices, volatility of the national currency, etc.), have a pronounced local component (various regimes and periods of quarantine measures due to the pandemic, the heterogeneity of regional support measures for business and the population). The degree of reaction of the markets of Russian cities to the observed crisis phenomena will also have a greater than usual amplitude.

One of the main influences on the degree of penetration of crisis phenomena into the largest cities of Russia will be provided by the structure of their economies, since the degree of damage from quarantine and other measures to combat coronavirus infection on different industries will be heterogeneous. To analyze these differences, we used data from the Institute for Urban Economics Foundation on the structure of the economy of Russian cities and the volume of gross urban product per capita.

Further, MACON consultants expertly assigned weight to each of the urban industries (classification of the Brookings Institution), depending on its vulnerability, recovery rate and predicted consequences. Coefficient "1" means the greatest stability / no influence, "0" - the smallest / complete or partial temporary liquidation of the industry.

Local / non-market services. The coefficient is 1.

The most stable segment, which includes state and municipal services, education, health care, social support of the population and other similar services. It is assumed that the volume of the sector will remain or grow due to additional indexation or one-time / permanent support measures.

Manufacturing industry. The coefficient is 0.8.

Despite a possible decline in output and employment, the sector is sufficiently stable. Severe quarantine measures often do not apply to him. Since such organizations, as a rule, belong to large businesses, they, on the one hand, are subject to additional supervision measures, on the other hand, the greatest support will be provided both directly financially and through government orders, tax incentives, subsidized interest rates and Facilitating access to debt financing.

Utilities. The coefficient is 0.8.

Industry maintains basic stability during a crisis. A negative impact is exerted by a decline in business activity, which is offset by an increase in the consumption of industry services by individuals. However, the difference in tariffs for individuals and businesses will have a negative impact on income.

Extraction of raw materials. The coefficient is 0.7.

In general, the sector includes mining, agriculture, forestry, hunting, fishing. The influence is more significant, the dynamics of commodity prices has a negative trend. Nevertheless, given the large volume of employment, the traditional volatility in this type of markets, the non-stop nature of many extractive industries, it is most likely that work will continue and basic employment will remain in the medium term (up to 6-7 months).

Construction. The coefficient is 0.5.

A significant negative coefficient is associated with the industry's high dependence on any macroeconomic fluctuations, as well as with the multiplier effect, due to which even a slight reduction in construction volumes causes significant changes in related industries. At the same time, the system-forming nature of the industry guarantees it a certain degree of state support and, consequently, stability.

Transport. The coefficient is 0.5.

A significant reduction in the sector is associated with both direct factors (almost complete elimination of air traffic, reduction of railway traffic, often a ban on movement within the city, between municipalities and constituent entities of the Federation), and indirect (decrease in the level of wholesale and retail trade). At the same time, the need to ensure commodity logistics guarantees the preservation of industry volumes at the level of acceptable values.

Business and finance. The coefficient is 0.4.

One of the most vulnerable urban industries, including financial services, insurance, real estate and new technologies. Each of them is characterized by both a significant decrease in business activity and a decrease in physical access to such services.

Trade and tourism. The coefficient is 0.1.

The retail and wholesale, catering, hospitality and conference services segment is the most affected industry. The assessment is aggravated by the low ability to quickly recover, the simplicity of liquidation procedures, the lack of access to credit resources and the insufficient level of government support.

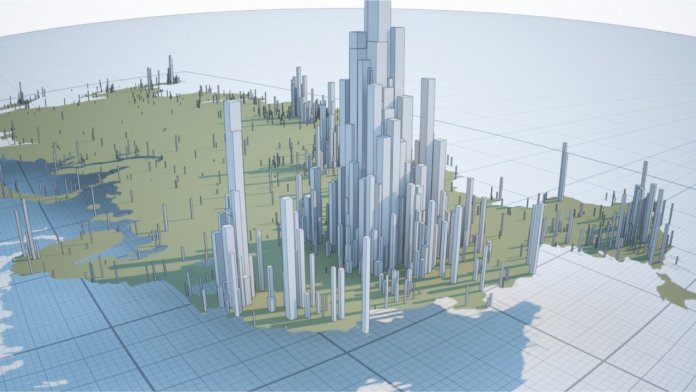

Based on the above factors, MACON consultants have compiled a rating of urban agglomerations in Russia in terms of potential resistance to the crisis in 2020:

- Perm

- Chelyabinsk

- Saratov

- Krasnoyarsk

- Ufa

- Vladivostok

- Volgograd

- Samara-Togliatti

- Rostov

- Voronezh.

The greatest stability is demonstrated by Perm, Chelyabinsk and Saratov agglomerations. In these cities, 60% or more of the economy is in 3 basic industries: local municipal / state non-market services, manufacturing and utilities. These industries are either fully controlled by the state / municipal authorities, or have a significant systemic / city-forming character, which allows them to receive priority benefits and preferences that contribute to the preservation of employment and production.

The least resistant to crisis phenomena were Moscow, St. Petersburg, Krasnodar, Yekaterinburg agglomerations. The share of the three basic industries (state services / industry / utilities), in contrast to the leaders of the rating, is significantly lower here: 44.4% versus 62.8%. However, the share of the “business and finance” and “trade and tourism” sectors, which are the most vulnerable in the current situation, is significantly higher (41.5% versus 22.7%). And if Moscow and St. Petersburg, in view of objectively broader financial possibilities, can neutralize these factors with active financial, tax and other support of the population and business, then non-capital cities do not have such a resource.

Correlation analysis of the dependence of the ranking results on the level of gross urban product per capita shows its significantly inversely proportional nature: the poorer the city, the more stable it is in the current crisis.The paradox of the situation lies in the fact that Russian agglomerations, which before the current crisis were actively developing as modern megalopolises with a large share of financial and business services, a developed construction market and IT technologies, today risk finding themselves in a much more difficult situation than municipalities whose economic structure characteristic of the "pre-digital" era. The latter are likely to receive both a significant part of budget subsidies and confidence that the course chosen earlier was extremely correct.