In order for the investor to be able to allocate risks and profitability as efficiently and profitably as possible, the Alpari brokerage company offers its clients to invest money not in separate PAMM accounts, but into the portfolios already collected by specialists.

PAMM portfolio represents an excellent diversification opportunity. Each Alpari index is compiled on the basis of a number of specific queries:

- The level of risk of draining the entire deposit;

- Maximum drawdown;

- Expected return;

- Nominal profit for the reporting period.

With an intuitive interface the best PAMM platform Alpari, investors can rank their investments at any time, weeding out low-income and adding more profitable assets.

We present the most profitable Alpari PAMM portfolios:

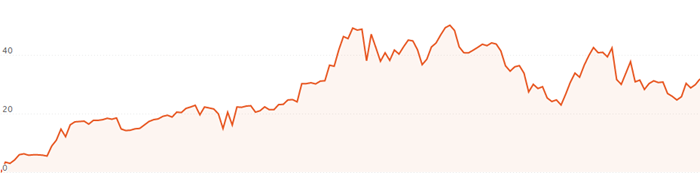

10. Manual-profit

It is one of the most reliable PAMM portfolios, consisting of seven accounts. The age of each account included in this PAMM index is at least eight months, which indicates stability, as well as a high purposefulness of managers. The current yield of the Manual-profit is 31.7%, which, given the recent monthly drawdown of 5.7%, is a high indicator of professionalism.

It is one of the most reliable PAMM portfolios, consisting of seven accounts. The age of each account included in this PAMM index is at least eight months, which indicates stability, as well as a high purposefulness of managers. The current yield of the Manual-profit is 31.7%, which, given the recent monthly drawdown of 5.7%, is a high indicator of professionalism.

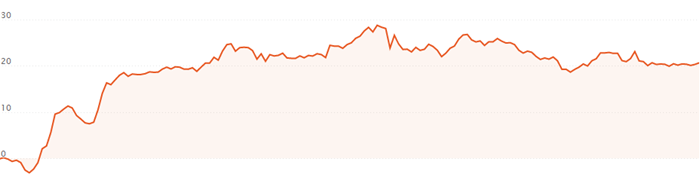

9. DEN - USD

Consists of eight accounts. Investment currency - US dollar. The current yield reaches 23%. The largest drawdown is no more than 3%. A promising young PAMM portfolio capable of bringing considerable profit in the future.

Consists of eight accounts. Investment currency - US dollar. The current yield reaches 23%. The largest drawdown is no more than 3%. A promising young PAMM portfolio capable of bringing considerable profit in the future.

8. Diversified

PAMM portfolio with a significant diversification indicator. Consists of twenty seven accounts of various ages and levels of profitability. At just seven months old, the index has already performed well, showing a profitability of 20.6%.

PAMM portfolio with a significant diversification indicator. Consists of twenty seven accounts of various ages and levels of profitability. At just seven months old, the index has already performed well, showing a profitability of 20.6%.

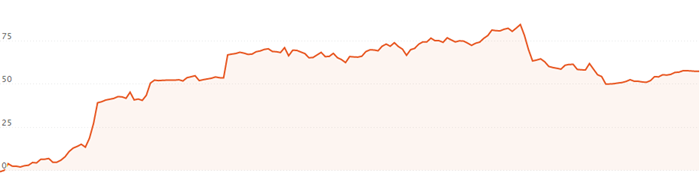

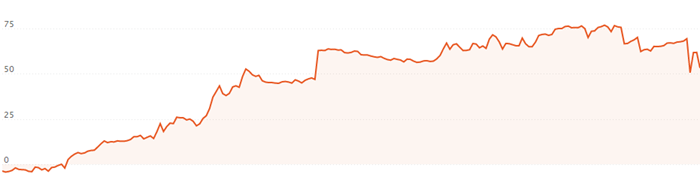

7. Levit

PAMM index, which includes only four accounts. But despite the low percentage of risk distribution, it shows a high rate of return - 57.2%. Such a high rate of return is due to the high professionalism of the managers, each of whom has been successfully working for at least one year.

PAMM index, which includes only four accounts. But despite the low percentage of risk distribution, it shows a high rate of return - 57.2%. Such a high rate of return is due to the high professionalism of the managers, each of whom has been successfully working for at least one year.

6. Ezoterik

Excellent balance of experience and perspective. Combines only two accounts: NightHunter2_Sx2 and SeeK with the age of sixteen days and over three years, respectively. It is characterized by high volatility of indicators, as a result of which it is an excellent opportunity to use the Scalping strategy, as well as to enter on drawdowns.

Excellent balance of experience and perspective. Combines only two accounts: NightHunter2_Sx2 and SeeK with the age of sixteen days and over three years, respectively. It is characterized by high volatility of indicators, as a result of which it is an excellent opportunity to use the Scalping strategy, as well as to enter on drawdowns.

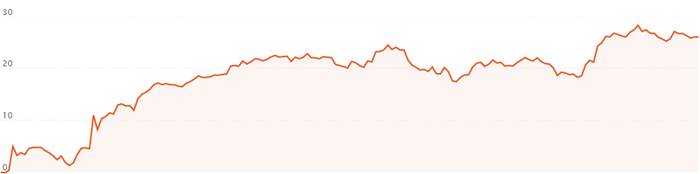

5. JacksonPAMM

Highly diversified with excellent profitability. The current yield is 53.1 percent. The age of the index is about ten months.

Highly diversified with excellent profitability. The current yield is 53.1 percent. The age of the index is about ten months.

4. Top 20 FX Index

Professionally selected PAMM portfolio. With the maximum profitability level of just over 30%, and the loss does not exceed 7%. The index has provided investors with stable and high returns for the past eleven months.

Professionally selected PAMM portfolio. With the maximum profitability level of just over 30%, and the loss does not exceed 7%. The index has provided investors with stable and high returns for the past eleven months.

3. A-Portfolio

It is characterized by an insignificant level of volatility and yield within 30%. It is the most diversified portfolio.

It is characterized by an insignificant level of volatility and yield within 30%. It is the most diversified portfolio.

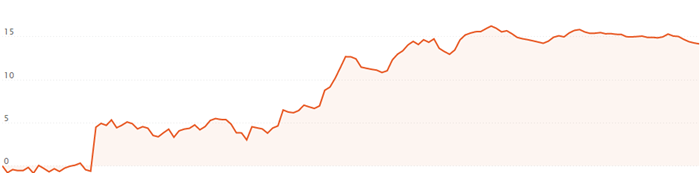

2. SR-Plus

One of the most conservative portfolios. The maximum recorded loss for six months of work is 2%, with a maximum profit of 18%.

One of the most conservative portfolios. The maximum recorded loss for six months of work is 2%, with a maximum profit of 18%.

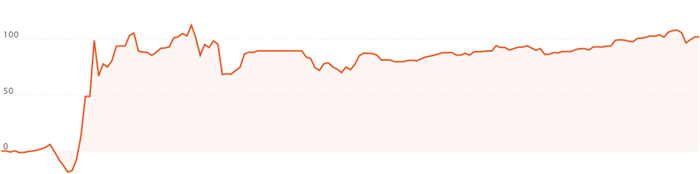

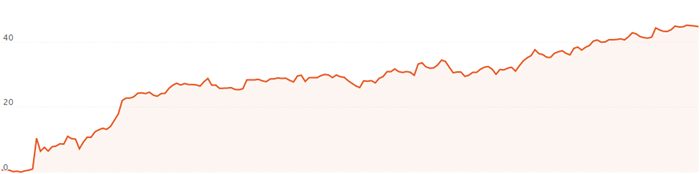

1. Stability

Since the formation of the portfolio, the profitability has already reached 44%, which is a fairly high indicator in the absence of drawdowns. An excellent combination of the experience of five managers.

Since the formation of the portfolio, the profitability has already reached 44%, which is a fairly high indicator in the absence of drawdowns. An excellent combination of the experience of five managers.

Based on the above presented rating, the level of profitability for different time slices can have strong volatility. But, if the investor wants to minimize the risk of his investments, you can use various PAMM portfolios. In doing so, the level of diversification reaches the highest level, providing a significant indicator of profitability with the lowest risks and possible losses.