PAMM account - a form of trust management in the Forex market, in which the investor's funds are actually in the personal account, but an experienced trader manages them (invests and conducts transactions). All this is not free. The managers set the amount of remuneration from twenty to fifty percent.

PAMM accounts scam or profit opportunity?

Many people wonder if it is possible to make money on PAMM accounts and how? There are not only advice from professionals and feedback from newbies, but also opinions that PAMM accounts are a scam. Many investors have lost their money trying to make money. But there are also a lot of those who consistently and successfully earn for a long time. Why does someone lose all their funds, while someone receives a consistently high income?

Many people wonder if it is possible to make money on PAMM accounts and how? There are not only advice from professionals and feedback from newbies, but also opinions that PAMM accounts are a scam. Many investors have lost their money trying to make money. But there are also a lot of those who consistently and successfully earn for a long time. Why does someone lose all their funds, while someone receives a consistently high income?

The main reason for the loss is fraudsters or unscrupulous dealing centers. Your own negligence in choosing a PAMM account also plays an important role. But as practice shows, excluding these two factors, making money on PAMM is a very real opportunity, the level of profit of which significantly exceeds all the wildest hopes on other trading floors in the world.

Investing in PAMM accounts: how to choose a broker

Investing in PAMM Forex is the best trust management option available on the Internet today.

Investing in PAMM Forex is the best trust management option available on the Internet today.

Main advantages:

- Control from anywhere in the world;

- Complete package of information for decision making;

- Freedom of choice. The investor decides for himself whom to entrust his funds;

- High rate of profitability. For example, investments in Alpari PAMM accounts bring up to one hundred percent of the net profit from the invested money.

![]()

Investing is characterized by simplicity, significant diversification opportunities and low time costs. One of the best ways to determine the profitability of investing in PAMM accounts is the 2019-2020 reviews:

“I have been investing in PAMM for several years, the profitability from year to year is about 75-95%. I chose accounts with very rare and minimal drawdowns, or with drawdowns that are compensated as soon as possible. "

Sergei

“You need to invest in PAMM only as much as you are not afraid to lose. Having studied a lot of reviews, including negative ones from competitors, I chose Alpari for myself. I did not invest in profitable and aggressive accounts, but in stable accounts. Now I have not a cosmic, but quite good monthly income. "

Chatterbox

“In 2019, the manager brought me 96% profitability. Now I diversified the risks and split the amount into 3 accounts. Let's see what 2020 will show. "

Andrew

“I have been working with Alpari for over 6 years. I would like to note that I have never had any significant complaints during this period. It can be seen that the company is growing and developing.For me this is the best PAMM service for today "

Pioner

How to choose a site for investment

Profitability directly depends on the chosen brokerage company, as well as the platform provided to them. One of the most effective ways to choose a profitable and secure platform is to use PAMM sites rating... The best companies will definitely be included in it.

Profitability directly depends on the chosen brokerage company, as well as the platform provided to them. One of the most effective ways to choose a profitable and secure platform is to use PAMM sites rating... The best companies will definitely be included in it.

Brokers rating:

- 4th place: Pantheon Finance

Has a good system. Easy to use. Perfect for beginners and professional investors. After beta testing, it is planned to put into operation a more advanced system; - 3rd place: Forex Trend

A platform with a high level of profitability. The broker provides investment services from the very beginning of the emergence of trust management in Russia; - 2nd place: FXOpen

One of the oldest investment sites. Characterized by the complexity of account management. May be inconvenient for beginners; - 1st place: Alpari

The oldest company in the financial services market. In addition to PAMM, it provides opportunities for investing in Forex and binary options. At Alpari, PAMM managers are characterized by a satisfactory level of profit and negligible risk.

Depending on the investment experience, you can pay attention to such components as ease of use (beneficial for beginners) and the average rate of return of managers working on the site.

Another equally important step is choosing an account.

How to choose an account for investment

How to choose a PAMM account for investing is a question that every investor asks himself when faced with market opportunities. Accounts are assessed according to two key criteria: risk level and return. The ratio of these criteria determines the success and profitability.

How to choose a PAMM account for investing is a question that every investor asks himself when faced with market opportunities. Accounts are assessed according to two key criteria: risk level and return. The ratio of these criteria determines the success and profitability.

When choosing, you should filter out unprofitable deposits (using a special filter). In the future, you should adhere to the following indicators:

- Age

The longer the account manager has been in operation, the higher the likelihood that the deposit will make a profit, and not be drained. The minimum period is twelve months; - Investor to Manager Money Ratio

The more investors invest in a managing trader, the higher the level of trust in him; - Maximum drawdown level

It allows you to effectively assess the probability of a complete loss of the deposit. If the manager has repeatedly approached the level margin cola, you should not trust him with your funds, his strategy is unreliable; - Manager's equity level

Shows how much the trader himself believes in his strategy. The higher the equity ratio, the higher the likelihood of a steady stream of profit - Profitability

Monthly profitability of at least 10-20 percent; - Loss rate

The maximum permissible loss rate is not more than five percent.

The choice may seem daunting at first, but if you take apart all the subtleties and factors that affect the level of its profitability, everything becomes extremely simple. Otherwise, you can use rating of PAMM accounts from all platforms.

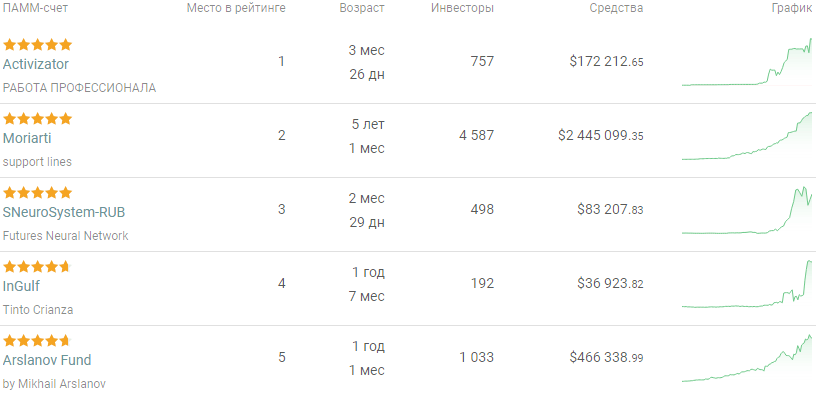

Below is a selection of promising accounts, a ready-made portfolio of the brokerage company Alpari.

| PAMM account | Min. Deposit | Profitability (year) | Risk | Volatility | Share |

|---|---|---|---|---|---|

| Moriarti | 50 $ | 111% | 1.34% | >7% | 25% |

| CartMan_in_da house | 50 $ | 659% | 1.39% | >7% | 25% |

| Moneymanagement | 50 $ | 132% | 1.23% | >7% | 20% |

| Goldclever | 50 $ | 27% | 1.31% | <5% | 15% |

| PEKOPDCMEH | RUB 3000 | 9% | 1.75% | <3% | 15% |

You can study the full Alpari PAMM-account rating, we have selected a list of the ten most promising managers out of hundreds.

The best Alpari PAMM accounts, truthful reviews of 2020

"Why say anything when the yield chart speaks for itself!"

Gr86 about the account Moriarti

“A very sensible approach to trading, designed for the future, and not craving for a big jackpot and a quick TOP. Keep it up."

Il; ya about the account CartMan_in_da house

“Thank you for the decent capital management and high performance indicators. I am writing against the background of drained funds in another PAMM account from the portfolio. "

Sergei about the account Moneymanagement

“I started investing in the Arslanov Fund account with NG.I think Alpari is the most reliable, since there is a license from the Federal Financial Markets Service, a certificate from KROUFR. In general, this is a licensed company in accordance with all Russian rules. Thanks to the manager for the good performance. I am very glad that I invested in your account, it was the right decision. "

Danial

PAMM indices (Portfolios): choice, advantages

PAMM indices - an ideal opportunity for investors who want to minimize the risks of their investments. The principle of PAMM indices is built on the key diversification rules - the accounts of managers with the most similar indicators of profitability and degree of risk are collected in a single portfolio.

PAMM indices - an ideal opportunity for investors who want to minimize the risks of their investments. The principle of PAMM indices is built on the key diversification rules - the accounts of managers with the most similar indicators of profitability and degree of risk are collected in a single portfolio.

For example, an investor wants to keep his funds, but get a small profit on them. To do this, select PAMM portfolios "Alpari" with the lowest risk and drawdown level. These indexes include managers with the most conservative approach to trading.

The benefits of such an investment:

- The minimum level of risk. Losses are almost impossible;

- There is no need to waste time on ranking, as well as choosing the most profitable manager (at the required level of risk);

- The minimum entry threshold. You can even invest a hundred dollars in the PAMM index.

For a more complete understanding of the structure, as well as the capabilities of the PAMM index, consider the following example. Suppose five accounts were used in the creation of the index with the following level of profitability:

- The first is thirty percent;

- The second is twenty percent;

- The third is twenty percent;

- The fourth is twenty percent;

- The fifth is ten percent.

If one or two managers show negative dynamics, then the other three will certainly bring profit, covering the loss of two unsuccessful traders. This approach is always profitable.

To select the most successful PAMM indices, use the portfolio rating.

Which is more profitable: mutual fund or PAMM

The main difference between PAMM and mutual fund - the level of risk and, as a result, profitability. For example, if you invest in a profitable mutual fund on a long-term basis, then there is practically no risk (in conditions of sustainable economic growth). The only risk of using mutual funds as investment instruments is not the professionalism of the management company or the linking of the share to a certain type of asset. For example, if a share is tied to gold (price dynamics), then in the event of a fall in the value of gold, the investor of the mutual fund will incur losses.

The main difference between PAMM and mutual fund - the level of risk and, as a result, profitability. For example, if you invest in a profitable mutual fund on a long-term basis, then there is practically no risk (in conditions of sustainable economic growth). The only risk of using mutual funds as investment instruments is not the professionalism of the management company or the linking of the share to a certain type of asset. For example, if a share is tied to gold (price dynamics), then in the event of a fall in the value of gold, the investor of the mutual fund will incur losses.

Compared to investing in mutual funds, investing in a PAMM account has great risks:

- Lack of a strictly prescribed legislative framework;

- The possibility of completely draining the deposit.

But with the risk comes profitability. If you can earn up to thirty percent on mutual funds, then for PAMM-accounts such a yield is of little interest. In the overwhelming majority of cases, the level of profitability of sites ranges from 60 to 80 percent per annum. There are frequent cases when managers bring the profitability of their transactions to 100 percent per annum.

If an investor considers investments as an active tool for making profit and increasing capital, then he should invest in PAMM accounts. If the goal is to preserve capital, and not increase it, you can invest in mutual funds. The choice is always up to the investor. But before making a final decision, you should contact those who are already successfully investing and making money.

PIF or PAMM, reviews

“The profitability of PAMM is several times higher, when investing in trusted managers you can earn very good money. Just remember that this is not an instant process. It takes several years to invest in PAMM to create capital. Then you can live on interest. "

Green

How to open an investment PAMM account

Let's consider the question of how to open a PAMM account using the example of the brokerage company Alpari. First you need to register on the official website of the broker.

![]()

After registration is completed, follow the instructions on the broker's website. In case of any questions, the most complete and accurate answer can be given by an online consultant 24/7.

Investment strategies: conclusion

Strategies for investing in PAMM accounts are the use of funds to obtain the highest possible level of profit or reduce the increased level of risk. The most common strategies are:

Strategies for investing in PAMM accounts are the use of funds to obtain the highest possible level of profit or reduce the increased level of risk. The most common strategies are:

Scalping

The scalping system can be successfully used not only for personal trading, but also in the PAMM market. The mechanism of the strategy is quite simple - wait for a drawdown and enter at the time of recovery. With a correctly calculated moment, the profitability indicator can reach 60 percent of the invested funds in a short period.

Distributed login

This strategy is a great way to minimize risks. To begin with, an account with a history of at least twelve months is selected. It is checked whether the deposit manager had drawdowns in the past, and if so, to what level. It is quite possible that the best way would be to split the funds into several different parts, and invest them after each new drawdown.

Conclusion

There are a huge number of algorithms for making a profit, but as practice shows, not all of them bring one hundred percent profit, and some even worse - a loss. According to market professionals, the best way to protect yourself and get high profits is to test the trading system as much as possible, and not just blindly follow the advice of numerous "gurus".