The year 2020 paints gloomy prospects for Russians. According to the forecast of the Center for Macroeconomic Analysis and Long-Term Forecasting, by the end of April, the army of Russian unemployed may be replenished with 10 million newcomers.

But many Russians have mortgages and other loans, and banks regularly remind them that what they have taken must be given back. But how to pay off the loan from the bank if there is no money? And what actions should be avoided in this case? We will answer these questions for you using the recommendations of lawyers, financial experts and the banks themselves. After all, financial and credit organizations are most interested in the fact that the client still repays the debt, albeit not immediately.

10. No need to borrow from another bank to repay the current loan

The worst thing to do in a crisis is to borrow money in an attempt to pay off current debt. This is a direct path to debt. And when you pay off one debt, the second may be even more.

The worst thing to do in a crisis is to borrow money in an attempt to pay off current debt. This is a direct path to debt. And when you pay off one debt, the second may be even more.

How to proceed in order not to take out a new loan: think about debt restructuring (we'll talk about this in more detail in this article). Track spending using the Home Bookkeeping software or any other. This will help identify unnecessary costs that can be reduced.

9. Don't panic

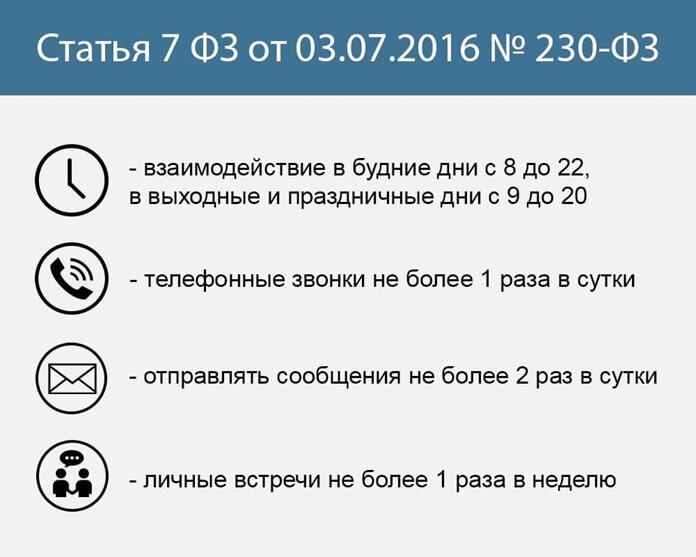

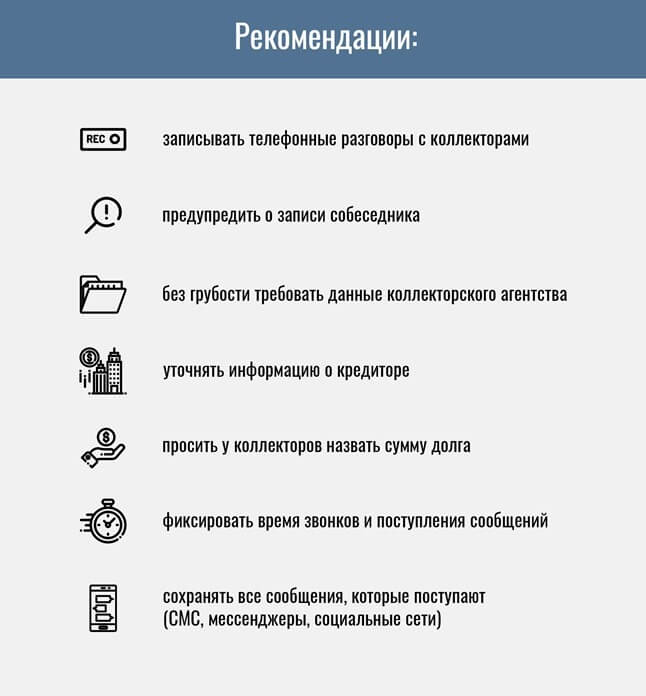

SMS from the bank with a reminder of the debt, calls with threats of court - all this is very unpleasant. But remember: physically you and your family are safe, collectors or other persons acting on behalf of your creditors can “crush” psychologically, but not physically. Their activities are regulated by Art. 7 Federal Law No. 230-FZ

What to do if collectors overcome:

- So that you are not tormented by phone calls, change your SIM card (it is advisable to do the same for your family members).

- If your debt is older than 4 months, write a statement of refusal to interact with third parties (collectors).

- If threats come from collectors, record them on a dictaphone or telephone and contact law enforcement agencies.

8. Go to the bank where you got the loan

Hiding from the bank until it takes your case to court is not the best way to solve the problem with an overdue loan. Especially if the mortgage "hangs" on you. Where will the family live if the mortgage housing is taken away?

Hiding from the bank until it takes your case to court is not the best way to solve the problem with an overdue loan. Especially if the mortgage "hangs" on you. Where will the family live if the mortgage housing is taken away?

The bank is not interested in recognizing your debt as hopeless and you as an unreliable borrower. He wants to return the money, you are ready to give it, but not now. So sit down at the negotiating table and find a compromise solution.

What can be done: agree with the bank to change the terms of credit service.

7. Agree on a new payment schedule

This method is suitable for people who plan to pay off their debt in full within the next 3-5 months.

This method is suitable for people who plan to pay off their debt in full within the next 3-5 months.

Call the bank's call center and explain the reason for the delay in payment of the loan. Ask the bank to postpone the payment date to the day of the month when you will definitely have money (benefits will come, receive a salary, etc.).

Why this method is not suitable for everyone: the option to postpone the payment date is not available in all banks.

6. Agree on a full deferral of loan payments

If there is no money, but it will appear in the next few months, try to agree with the bank on a full deferral of loan payments for this period. Just explain where you will get the money.

If there is no money, but it will appear in the next few months, try to agree with the bank on a full deferral of loan payments for this period. Just explain where you will get the money.

It is important to consider: the loan term will increase, and the bank will evenly distribute the interest on the loan on the remaining payments.

5. Ask the bank to restructure the debt

Debt restructuring is a change in the terms of a loan. For example, you took out a loan of 200 thousand rubles for a period of 2 years, with a 10% interest rate. And every month they have to give the bank 9,229 rubles.

Debt restructuring is a change in the terms of a loan. For example, you took out a loan of 200 thousand rubles for a period of 2 years, with a 10% interest rate. And every month they have to give the bank 9,229 rubles.

But in the case of debt restructuring, the bank can extend the lending period, for example, up to 3 years, while the monthly payment will decrease. Or you can refinance a loan at another bank with a more favorable interest rate. This is a good way out if you have not yet become a debtor to the bank.

How to restructure bank debt: ask the bank in writing to change the due date or schedule. Do not try to stretch the payment schedule too much, hardly any bank will agree to wait 3 years or more for the return of a consumer loan for 50 thousand rubles.

4. Collect all documents that can help restructure debt

The bank may be more willing to meet you halfway if you documentarily prove why you cannot now pay on a mortgage or other loan. The documents confirming the objective reasons for your lack of money include:

The bank may be more willing to meet you halfway if you documentarily prove why you cannot now pay on a mortgage or other loan. The documents confirming the objective reasons for your lack of money include:

- birth certificate of a child;

- certificate of death of the co-borrower on the loan;

- extracts from a medical card and receipts from a medical institution, if your loan delay is related to your hospital stay;

- reduction order, copy of work book;

- 2-NDFL certificate;

- certificate of disability;

- a copy of the protocol on an administrative offense if you got into an accident and lost the vehicle that was the source of income.

This is not a complete list, but we hope it gave an idea that you need to collect any certificates that can confirm that you cannot repay the loan through no fault of your own.

3. Arrange a loan vacation

A credit vacation is a period during which the debtor only needs to pay the interest on the loan. Such vacations usually last no longer than 12 months. And when they are over, the amount of the monthly payment will increase, since the loan debt has not gone anywhere.

A credit vacation is a period during which the debtor only needs to pay the interest on the loan. Such vacations usually last no longer than 12 months. And when they are over, the amount of the monthly payment will increase, since the loan debt has not gone anywhere.

We recommend: try to negotiate not only a loan vacation, but also an extension of the loan term. This way you will not have to pay substantially more each month after the loan deferral ends.

2. Contact the Financial Ombudsman

The task of the financial ombudsman is to act as an intermediary between individuals and financial institutions, helping to keep the case from going to court. His services are free, however, there are several conditions under which you can contact him for help:

The task of the financial ombudsman is to act as an intermediary between individuals and financial institutions, helping to keep the case from going to court. His services are free, however, there are several conditions under which you can contact him for help:

- the problem with which you contacted the financial ombudsman arose no later than 3 years ago;

- your debt to the bank does not exceed 500 thousand rubles;

- the bank from which you took out a loan voluntarily agrees to resolve disputes with the ombudsman. You can view a list of such banks on the Bank of Russia website. Important: from January 1, 2021, banks will be required to cooperate with financial commissioners.

The Ombudsman will not liquidate your debt to the bank, he can help you restructure it, get a grace period for payments, or find another solution that suits both you and the bank.

1. Declare yourself bankrupt

Before you sigh happily: “Well, that's what I had to start with,” please note that there is no option to declare bankruptcy and not pay the loan.

Before you sigh happily: “Well, that's what I had to start with,” please note that there is no option to declare bankruptcy and not pay the loan.

- Financial bankruptcy means that a person cannot fulfill their debt obligations to the bank and third parties.

- What will the bank do in such a situation? He will go to court, based on the results of which a debt repayment scheme will be drawn up. Probably, part of the debt will be repaid through property confiscation. Personal belongings, household appliances, electronics, housing (if it is not the only one or is pledged by the bank) - everything will go under the hammer for debts.

- At the same time, the debtor may be exempted from paying fines and penalties, but at the same time he is blacklisted, and is unlikely to ever receive a loan for a large amount. And even getting a debit card can be difficult.

Conditions for declaring bankruptcy: the amount of the debt is from 500 thousand rubles, the debt period is at least 90 days.

Benefits of bankruptcy status:

- You no longer need to make obligatory loan payments (with the exception of taxes, fees, fines).

- Penalties and interest on liabilities are not charged.

- After the sale of the debtor's property, the bank no longer has the right to impose property claims on it.

Disadvantages of bankruptcy status:

- Within 5 years, you cannot declare bankruptcy again and you need to notify the bank from which you want to take out a loan that you went through bankruptcy proceedings.

- During the trial, you cannot buy and sell property, pledge it, manage money in your bank accounts, or travel abroad except with the permission of the court.

- For 3 years after the bankruptcy procedure, you cannot hold any position in the management bodies of a legal entity.

We hope one of the tips on how to pay off debts to the bank if there is no money turned out to be useful to you. Be healthy and financially sound!