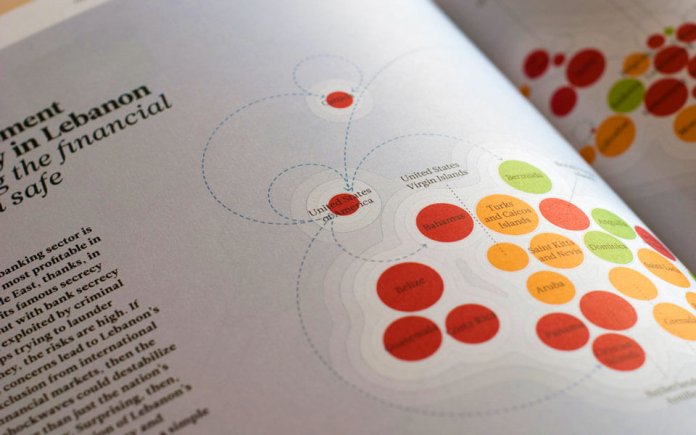

The Tax Justice Network, an independent international organization, compiles every two years Financial Transparency Index... It ranks countries according to the secrecy and scale of their offshore financial activities.

The main goal of the Index is to demonstrate that not only offshore companies on exotic and underdeveloped islands, but also quite prosperous, progressive states can be reliable tax havens.

Financial Secrecy Index 2018

| A place | Country | FSI value | Share | Secrecy | World weight |

|---|---|---|---|---|---|

| 1 | Switzerland | 1,589.57 | 5.01% | 76 | 4.50% |

| 2 | USA | 1,298.47 | 4.09% | 60 | 22.30% |

| 3 | Cayman Islands | 1,267.68 | 3.99% | 72 | 3.78% |

| 4 | Hong kong | 1,243.67 | 3.92% | 71 | 4.16% |

| 5 | Singapore | 1,081.98 | 3.41% | 67 | 4.57% |

| 6 | Luxembourg | 975.91 | 3.07% | 58 | 12.13% |

| 7 | Germany | 768.95 | 2.42% | 59 | 5.16% |

| 8 | Taiwan | 743.37 | 2.34% | 76 | 0.50% |

| 9 | United Arab Emirates (Dubai) | 661.14 | 2.08% | 84 | 0.14% |

| 10 | Guernsey | 658.91 | 2.07% | 72 | 0.52% |

| 11 | Lebanon | 644.41 | 2.03% | 72 | 0.51% |

| 12 | Panama | 625.84 | 1.97% | 77 | 0.26% |

| 13 | Japan | 623.91 | 1.96% | 60 | 2.23% |

| 14 | Netherlands | 598.80 | 1.88% | 66 | 0.90% |

| 15 | Thailand | 550.59 | 1.73% | 80 | 0.12% |

| 16 | British Virgin Islands | 502.75 | 1.58% | 69 | 0.37% |

| 17 | Bahrain | 490.70 | 1.54% | 78 | 0.11% |

| 18 | Jersey | 438.21 | 1.38% | 65 | 0.38% |

| 19 | Bahamas | 429.00 | 1.35% | 84 | 0.03% |

| 20 | Malta | 426.31 | 1.34% | 61 | 0.71% |

| 21 | Canada | 425.84 | 1.34% | 55 | 1.74% |

| 22 | Macao | 424.91 | 1.34% | 68 | 0.23% |

| 23 | United Kingdom | 423.76 | 1.33% | 42 | 17.36% |

| 24 | Cyprus | 404.44 | 1.27% | 61 | 0.54% |

| 25 | France | 404.17 | 1.27% | 52 | 2.52% |

| 26 | Ireland | 387.94 | 1.22% | 51 | 2.66% |

| 27 | Kenya | 378.34 | 1.19% | 80 | 0.04% |

| 28 | China | 372.57 | 1.17% | 60 | 0.50% |

| 29 | Russia | 361.15 | 1.13% | 64 | 0.26% |

| 30 | Turkey | 353.88 | 1.11% | 68 | 0.14% |

| 31 | Malaysia (Labuan) | 335.10 | 1.05% | 72 | 0.07% |

| 32 | India | 316.62 | 0.99% | 52 | 1.16% |

| 33 | South korea | 314.05 | 0.99% | 59 | 0.35% |

| 34 | Israel | 313.55 | 0.98% | 63 | 0.19% |

| 35 | Austria | 310.41 | 0.97% | 56 | 0.56% |

| 36 | Bermuda | 281.82 | 0.88% | 73 | 0.03% |

| 37 | Saudi arabia | 278.57 | 0.87% | 70 | 0.05% |

| 38 | Liberia | 277.28 | 0.87% | 80 | 0.01% |

| 39 | Marshall Islands | 275.28 | 0.86% | 73 | 0.03% |

| 40 | Philippines | 269.81 | 0.85% | 65 | 0.09% |

| 41 | Italy | 254.14 | 0.80% | 49 | 0.92% |

| 42 | Isle of man | 248.68 | 0.78% | 64 | 0.09% |

| 43 | Ukraine | 246.24 | 0.77% | 69 | 0.04% |

| 44 | Australia | 244.35 | 0.77% | 51 | 0.60% |

| 45 | Norway | 242.84 | 0.76% | 52 | 0.55% |

| 46 | Liechtenstein | 240.85 | 0.76% | 78 | 0.01% |

| 47 | Romania | 232.30 | 0.73% | 66 | 0.05% |

| 48 | Barbados | 230.95 | 0.72% | 74 | 0.01% |

| 49 | Mauritius | 223.47 | 0.70% | 72 | 0.02% |

| 50 | South africa | 216.43 | 0.68% | 56 | 0.18% |

| 51 | Poland | 215.39 | 0.67% | 57 | 0.14% |

| 52 | Spain | 213.88 | 0.67% | 48 | 0.76% |

| 53 | Belgium | 212.96 | 0.67% | 44 | 1.56% |

| 54 | Sweden | 203.54 | 0.64% | 45 | 1.01% |

| 55 | Latvia | 195.64 | 0.61% | 57 | 0.11% |

| 56 | Anguilla | 195.03 | 0.61% | 78 | 0.00% |

| 57 | Indonesia | 188.78 | 0.59% | 61 | 0.05% |

| 58 | New Zealand | 178.56 | 0.56% | 56 | 0.10% |

| 59 | Costa Rica | 168.77 | 0.53% | 69 | 0.01% |

| 60 | Chile | 168.64 | 0.53% | 62 | 0.03% |

| 61 | Denmark | 166.11 | 0.52% | 52 | 0.15% |

| 62 | Paraguay | 158.52 | 0.50% | 84 | 0.00% |

| 63 | St. Kitts and nevis | 152.54 | 0.48% | 77 | 0.00% |

| 64 | Portugal (Madeira) | 151.62 | 0.47% | 55 | 0.08% |

| 65 | Puerto rico | 151.06 | 0.47% | 77 | 0.00% |

| 66 | Vanuatu | 149.26 | 0.47% | 89 | 0.00% |

| 67 | Uruguay | 148.20 | 0.46% | 61 | 0.02% |

| 68 | Aruba | 148.04 | 0.46% | 76 | 0.00% |

| 69 | Dominican Republic | 147.08 | 0.46% | 72 | 0.00% |

| 70 | Czech Republic | 145.10 | 0.45% | 53 | 0.09% |

| 71 | Finland | 142.23 | 0.44% | 53 | 0.09% |

| 72 | Iceland | 139.69 | 0.44% | 60 | 0.02% |

| 73 | Brazil | 137.99 | 0.43% | 49 | 0.16% |

| 74 | Hungary | 132.73 | 0.41% | 55 | 0.05% |

| 75 | Tanzania | 128.91 | 0.40% | 73 | 0.00% |

| 76 | Slovakia | 127.88 | 0.40% | 55 | 0.04% |

| 77 | Seychelles | 125.26 | 0.39% | 75 | 0.00% |

| 78 | Guatemala | 123.62 | 0.39% | 73 | 0.00% |

| 79 | Croatia | 119.36 | 0.37% | 59 | 0.01% |

| 80 | Greece | 118.58 | 0.37% | 58 | 0.02% |

| 81 | Samoa | 115.90 | 0.36% | 78 | 0.00% |

| 82 | Mexico | 107.57 | 0.33% | 54 | 0.03% |

| 83 | Gibraltar | 107.44 | 0.33% | 71 | 0.00% |

| 84 | Curacao | 105.65 | 0.33% | 75 | 0.00% |

| 85 | Venezuela | 105.03 | 0.33% | 69 | 0.00% |

| 86 | US Virgin Islands | 101.89 | 0.32% | 73 | 0.00% |

| 87 | Turks and Caicos Islands | 98.07 | 0.30% | 77 | 0.00% |

| 88 | Bolivia | 94.82 | 0.29% | 80 | 0.00% |

| 89 | Bulgaria | 91.38 | 0.28% | 54 | 0.01% |

| 90 | Belize | 86.30 | 0.27% | 75 | 0.00% |

| 91 | Brunei | 85.59 | 0.27% | 84 | 0.00% |

| 92 | Monaco | 82.93 | 0.26% | 78 | 0.00% |

| 93 | Estonia | 79.46 | 0.25% | 51 | 0.02% |

| 94 | Maldives | 74.87 | 0.23% | 81 | 0.00% |

| 95 | Ghana | 68.85 | 0.21% | 62 | 0.00% |

| 96 | Dominica | 62.02 | 0.19% | 77 | 0.00% |

| 97 | Lithuania | 58.74 | 0.18% | 47 | 0.01% |

| 98 | Antigua and Barbuda | 54.53 | 0.17% | 87 | 0.00% |

| 99 | Montenegro | 52.64 | 0.16% | 63 | 0.00% |

| 100 | Cook Islands | 44.97 | 0.14% | 75 | 0.00% |

| 101 | Grenada | 44.60 | 0.14% | 77 | 0.00% |

| 102 | Macedonia | 39.76 | 0.12% | 61 | 0.00% |

| 103 | Botswana | 39.44 | 0.12% | 69 | 0.00% |

| 104 | Slovenia | 35.32 | 0.11% | 42 | 0.01% |

| 105 | Andorra | 35.05 | 0.11% | 66 | 0.00% |

| 106 | Gambia | 34.51 | 0.10% | 77 | 0.00% |

| 107 | Trinidad and Tobago | 27.86 | 0.08% | 65 | 0.00% |

| 108 | Nauru | 26.32 | 0.08% | 67 | 0.00% |

| 109 | San marino | 24.31 | 0.07% | 64 | 0.00% |

| 110 | St. Lucia | 21.52 | 0.06% | 78 | 0.00% |

| 111 | St. Vincent and the Grenadines | 21.37 | 0.06% | 70 | 0.00% |

| 112 | Montserrat | 16.53 | 0.05% | 78 | 0.00% |

Moreover, the top ten includes countries whose government is ready to mercilessly fight tax evaders ... on the territory of other countries.

This is what the top 10 countries with the highest financial secrecy look like.

10. Island of Guernsey

The Financial Secrecy Index of Guernsey - an island with a population of 60 thousand people - has climbed 7 positions up from the previous rating. It accounts for 0.5% of world trade in offshore financial services.

As a result of the sheer size of the island's offshore industry, the financial sector dominates the local economy. According to the Guernsey Statistical Office, 21% of the workforce is employed in the financial sector, and this sector accounts for about 40% of gross value added.

In words, the tax haven government supports international anti-money laundering standards. However, when it comes to public access to sensitive corporate data, Guernsey is becoming a "territory of silence."

9. UAE (Dubai)

Dubai is an important financial center in the Middle East. Its status is based mainly on financial flows from the oil-rich region, and also due to the historical role of Dubai as a convenient trading gateway between Europe and fast-growing Asia.

The Dubai Financial Center itself is described in all materials as “a financial center in a full tax territory”, that is, it does not provide tax benefits. At the same time, the compilers of the 2018 financial secrecy rating have no doubts that Dubai is one of the best tax havens in the world. It is located in a free trade zone, has a low tax rate and many banking secrets.

Much of the financial flows that flock to Dubai come in the form of cash or gold.

8. Taiwan

First, but not the last Asian country in the top 10 financial transparency.

The first detailed analysis of Taiwan as an offshore center came in July 2017 thanks to the CORPNET research team at the University of Amsterdam.

The researchers found that Taiwan is one of the most famous offshore capital destinations in the world. The study's findings came as a surprise to the research team, which noted that previous studies based on IMF data had missed Taiwan.And all because the country does not participate in the IMF statistics under pressure from China.

Looking at the importance of Taiwan in the offshore world, the researchers noted: “Taiwan's prominence is due to its technology companies, which often own Chinese firms through Hong Kong (33%) and the Caribbean (20%) or their own firms in Hong Kong through the Caribbean (12%) ".

7. Germany

Germany accounts for more than 5% of the global offshore financial services market. The German government has an ambiguous view of financial secrecy. In recent years, Germany has taken important steps to combat tax evasion and money laundering both internationally and nationally.

However, serious holes remain in German law, and the careless application of tax and anti-money laundering rules poses a threat to the effectiveness of the fight against tax evaders.

At the same time, the German government opposes public registries of beneficial ownership, and one-way automatic filing of tax information to developing countries, insisting on mutual exchange.

6. Luxembourg

The Grand Duchy of Luxembourg is ranked sixth in the 2018 Financial Secrets Index, thanks to a very large market share of offshore financial services (over 12 percent of the global).

Until recently, Luxembourg was the death star of banking secrecy in Europe due to its aggressive stance towards European financial transparency initiatives. However, from 2013 to 2015, Luxembourg joined various international financial information exchange initiatives.

Despite these improvements, Luxembourg remains one of the most important offshore zones in the world. The duchy has over 1000 investment funds and about 200 banks - more than in any city on Earth.

5.Singapore

The former British colony accounts for over four percent of the global offshore financial services market.

Singapore vies with Hong Kong for the title of Asia's Leading Offshore Financial Center. Singapore primarily serves Southeast Asia, while Hong Kong primarily serves China and North Asia. However, many Chinese and North Asian financial investors, unhappy with China's control over Hong Kong, prefer to keep their assets in a more independent Singapore.

Despite Singapore's clear Asian focus, a significant portion of bank deposits into the country come from the United States and England.

4. Hong Kong

The Special Administrative Region of the PRC has a fairly high secrecy rate (71 out of 100 possible), and it accounts for 4.17% of the global offshore financial services market. Moreover, this figure is growing every year.

Hong Kong's formal role as a Special Administrative Region of China has two main components that underpin offshore financial success:

- Firstly, the protection provided to Hong Kong by China reassures offshore players;

- secondly, Hong Kong enjoys a high degree of autonomy from China on all issues other than foreign relations and defense, which allows the Chinese authorities to have little or no interference in the Hong Kong financial sector.

3. Cayman Islands

One of the most famous offshore companies in the world. The Cayman Islands are an overseas territory of the United Kingdom. Thus, they have significant political and economic autonomy from the UK, while also having strong support and oversight from the UK. This connection gives the owners of financial assets the confidence that they can get help from the British Themis if necessary, and that the UK will ensure the political stability of the islands.

Previously, the Cayman Islands served as a turning point for drug smuggling and money laundering.However, now most of the business on the islands is quite legal, and is associated with the largest banks, corporations, hedge funds and other organizations. In general terms, the Cayman Islands offer a low tax and low regulatory environment for financial players from all over the world, especially Europe and the United States.

2. USA

Between 2015 and 2018, America's share of the global offshore financial services market increased by 14% to 22.3%.

While the American authorities are constantly looking for ways to protect themselves from foreign tax havens, they do not give much thought to the role of their state in attracting illegal financial flows.

Rather than agreeing to join a new multilateral automated exchange of financial information (CRS) standard, America is sticking to its own FATCA model, which does not appear to be related to CRS, despite technical similarities. An independent US approach has hampered the international fight against tax evasion, money laundering, and financial crime.

But Russia joined CRS in 2016.

1. Switzerland

The most "opaque" country in terms of disclosure of financial information does not change its reputation as a reliable international "bank safe".

Switzerland is one of the largest offshore financial centers in the world and one of the world's largest tax havens. According to the Swiss Bankers Association, there are 6.6 trillion Swiss francs ($ 6.5 trillion) in the country, of which 48% is sourced from abroad. This makes Switzerland a world leader in international cross-border asset management. It owns a 25% share of this market.

In addition to asset management and wealth management, Switzerland offers investment banking services, hedge funds and tax evasion structures, offshore companies and trusts, and many other financial services.

Russia in the financial secrecy index

Our country is in 29th place (64 points) in the list of countries with the most opaque financial system. This is worse compared to the position in the previous ranking (30th place with 54% opacity). However, last time the Index compilers took into account fewer parameters.