Every beginner or experienced trader wants to earn more. But not all of them have the necessary investment. The Pamm account system creates excellent conditions for finding investors without lengthy negotiations and paperwork. The article material will help resolve the dilemma, where is the best place to open a Pamm account and not to miscalculate on which site it is more profitable to be the manager of the Pamm account.

Where to open a Pamm account: rating of the best brokers

5. FXTM

FXTM is a broker that has been trading since 2011, quickly becoming one of the leaders on the international exchange market. During the first year of operation, the company was able to attract large corporations and successful individual traders.

FXTM is a broker that has been trading since 2011, quickly becoming one of the leaders on the international exchange market. During the first year of operation, the company was able to attract large corporations and successful individual traders.

Benefits of trading with FXTM:

- Operational support service in Russian;

- A wide range of trading instruments (futures, indices, precious metals);

- Individual affiliate programs;

- Careful selection of investment portfolios.

Disadvantages of FXTM:

- Unexpected high spread that does not correspond to the declared level;

- Problems with depositing and withdrawing funds;

- Cancellation of transactions without good reason;

- Personal account without Russian;

- High commission for withdrawals.

The broker offers the following terms of cooperation:

- Withdrawal fees range from $ 3 to $ 5;

- The income of managers is at the level of 20-25%;

- The minimum investment level is $ 100;

- All information about the manager and the volume of investments from the broker is confidential and closed for free access.

4. RoboForex

Like the previous broker, RoboForex is registered in Cyprus. The company offers an interesting program of Ramm-accounts, combining Pamm-accounts with a service for copying transactions.

Like the previous broker, RoboForex is registered in Cyprus. The company offers an interesting program of Ramm-accounts, combining Pamm-accounts with a service for copying transactions.

Advantages of Pamm trading at RoboForex:

- The ability to invest in one strategy several times with different ratios of profitability and risk;

- The minimum investment is $ 10;

- You can trade on one account independently using free funds;

- Built-in risk and profitability assessment system.

The disadvantages of RoboForexa are as follows:

- There is no possibility of counter and partial closing of orders;

- The terminal has no graphical functionality.

RoboForex provides a similar list of conditions:

- The minimum amount of funds to create a strategy is $ 50;

- The minimum order volume step is 0.000001;

- Manager's income up to 50% of the investors' profit;

- Only one strategy can be opened through one RAMM account.

3. InstaForex

It is an ECN broker category with more than 100 offices worldwide. Each transaction on the site is displayed on the electronic currency market. If you don't know how to open a Pamm account with minimal investment, then you are at the right place.

It is an ECN broker category with more than 100 offices worldwide. Each transaction on the site is displayed on the electronic currency market. If you don't know how to open a Pamm account with minimal investment, then you are at the right place.

InstaForex advantages:

- Portfolio diversification;

- Convenient service for copying transactions;

- The ability to use binary options for investment;

- Reliable technical support.

Disadvantages, like any other company, are:

- Information congestion of the site and interface;

- A large number of negative feedback from traders about the cancellation of profitable trades;

- Lack of information on the site about licenses and other statutory documents.

Conditions for opening a Pamm account:

- The minimum investment is $ 1;

- Bonus system for account replenishment (30-250%);

- Profitability up to 70% in the Pamm-partnership system from attracting investors;

- Cent accounts are open for beginners, 4 types of standard accounts for experienced managers.

2. Forex Club

How to open a Pamm account on Forex? Nothing complicated. ForexClub is one of the most reliable brokers. The company has been operating since 1997.

How to open a Pamm account on Forex? Nothing complicated. ForexClub is one of the most reliable brokers. The company has been operating since 1997.

The advantages of opening and managing a Pamm account on Forex:

- Detachment of investments from the account at any time;

- The possibility of introducing an automatic stop;

- Losses are borne by the investor;

- A wide range of financial instruments where you can invest.

The disadvantages are:

- Insufficient development of risk multipliers;

- Many multiplier moves distort returns.

Conditions for opening a Pamm account on Forex:

- The minimum investment is $ 100;

- Fixed spread from 2 pips;

- No commission;

- The minimum lot is 0.01, the maximum is 10;

- The maximum order level is set at 100;

- The manager's income is determined by himself in the terms of the offer;

- The minimum investment amount is $ 20;

- Additional attraction of investors is allowed at any time.

1. Alpari

It is the oldest broker on the Russian and CIS market. Alpari, unlike other brokers in the country, freely provides its performance indicators and the names of managers for review. The site has many regalia and awards, is actively involved in the cultural and sports life of the country.

At Alpari, over 40,000 investors in 2017 invested their funds in Pamm accounts and over 5,000 in Pamm portfolios.

Alpari provides excellent conditions for cooperation with investors under the Pamm accounts program. How to become a manager of a PAMM account at Alpari?

Its main advantages are recognized:

- A wide variety of investment funds, portfolios and pamm accounts;

- Convenient filter for searching contracts;

- No delays in payments;

- Manager's multilevel offer;

- Low spreads and good quotes;

- The presence of a cent account;

- Possibility of free training;

- Convenient platform interface.

- Permanent promotions and contests.

Alpari's disadvantages exist, but in small quantities:

- Commissions for replenishment of accounts;

- Imperfect affiliate program.

How to open a Pamm account with Alpari? The conditions are as follows:

- The first level of the offer from $ 50 for public and non-public accounts;

- Up to 46 currency pairs;

- The possibility for managers to receive income up to 50% of the profit;

- Floating leverage on all accounts, except cent;

- Entry requests - 24 times a day, each rollover;

- Withdrawal requests from 1 to 24 times a day.

This is all about opening an account. But how can you become your own Pamm manager at Alpari? Alpari offers a reliable affiliate program. According to the service, the manager can attract a business partner or an attraction partner who will look for investors for Pamm accounts.

Alpari's Cashback program awards points to traders that can be freely converted into money. If you wish, you can connect a system for refunding part of the costs for certain services. The broker has a competition for the best portfolio manager, the prize fund of which is $ 1,000. To win, you need to demonstrate the best ratio of portfolio return to drawdown.

How to become a PAMM manager step by step

check in

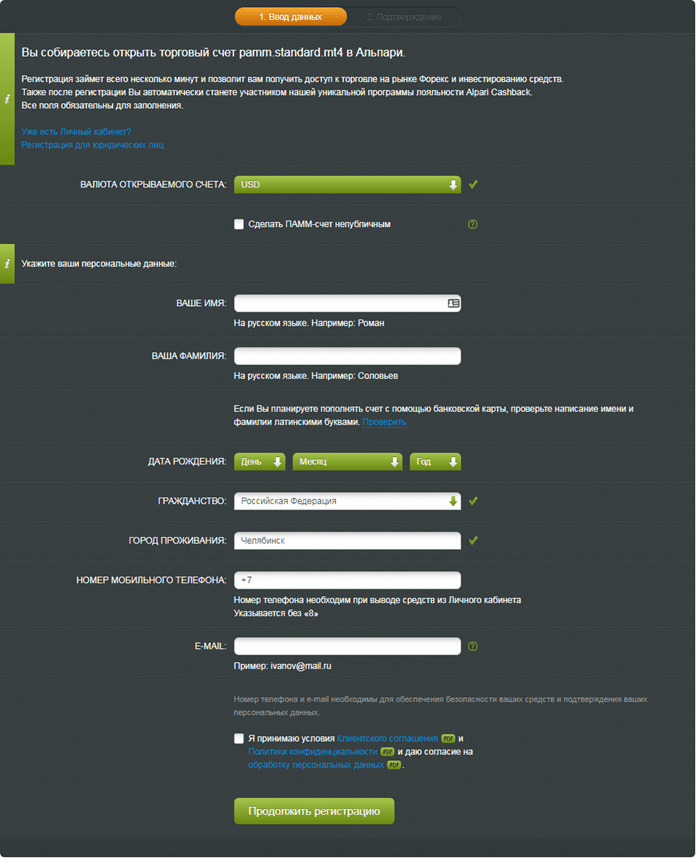

If you do not have an account on the site yet, you should register on the official Alpari website. In the registration column, you must enter the necessary information about yourself.

If you do not have an account on the site yet, you should register on the official Alpari website. In the registration column, you must enter the necessary information about yourself.

Opening a Pamm account

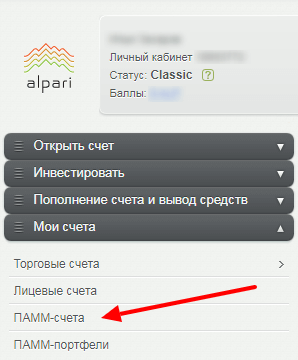

To do this, you need to confirm the registration and go to your personal account. In the menu on the left, click the "My accounts" tab and select "Pamm account".

Then we press the button "Open Pamm-account". It will later reflect all the parameters related to it.

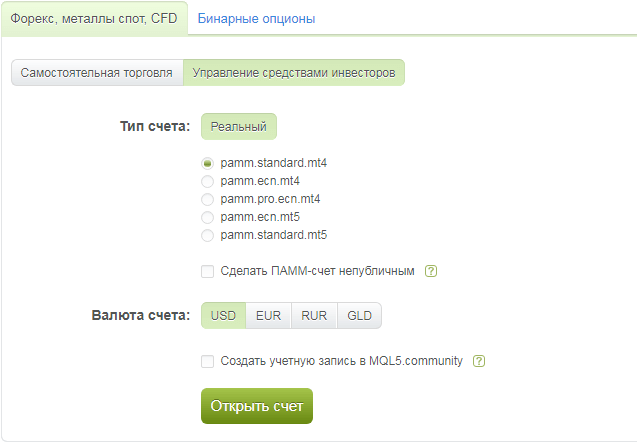

The "Forex, spot metals, CFDs" tab and the "Investor funds management" subtab will appear immediately.

Here on the right you will need to select the type of account, its publicity or non-publicity.

After that, select the account currency and, if desired, create an entry in the MQL5.community. This will allow access to the app store and the store of original moves.

Click "Open an account".

Account start

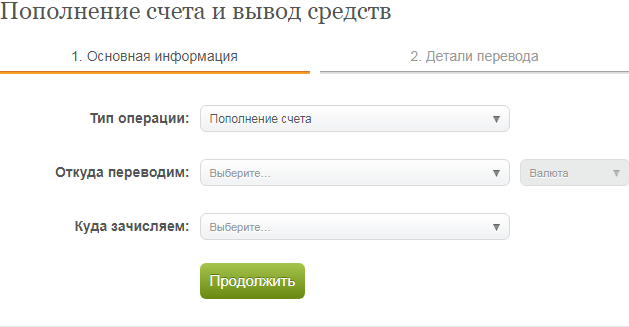

To activate your account, you need to fund it.

After the replenishment, the “Offer”, “Partners”, “Investment accounts”, “Applications and planner” and “Declaration” tabs will become available.

Control activation

In order to start managing your Pamm account, you need to submit an offer. To do this, go to the "Offer" tab and enter all the necessary conditions for cooperation with investors.

Account binding

Be sure to give a name to the Pamm account and link your account operating on the traders forum to it. This is necessary for more convenient communication with future investors.

Investor search

Obviously, in order to attract investors, the Pamm account must be public. The more information it contains, reflecting your success in the auction, the better. The impressive amount of funds on the account will also attract investors to you. You can actively search in specialized business or investment forums.

Trade yourself, and if your indicators reflect a good result, more and more investors will pay attention to your candidacy as a manager. We will publish detailed instructions on attracting investors shortly.